Ups And Downs Valuing Cyclical And Commodity Companies

Valuing cyclical and commodity companies introduction uncertainty and volatility are endemic to valuation but cyclical and commodity companies have volatility thrust upon them by external factors the ups and downs of the economy with cyclical companies and movements in commodity prices with commodity companies. Other industries that might be considered cyclical in nature include.

Http People Stern Nyu Edu Adamodar Pdfiles Papers Commodity Pdf

New york university stern school of business.

Ups and downs valuing cyclical and commodity companies. Cyclical and commodity companies share a common feature insofar as their value is often more dependent on the movement of a macro variable the commodity price or the growth in the underlying economy than it is on firm specific characteristics. If you need immediate assistance call 877 ssrnhelp 877 777 6435 in the united states or 1 212 448 2500 outside of the united states 830am to 600pm us. Published work ups and downs.

They often exist along industry lines. We mentioned auto manufacturers as a prime example of companies that have cyclical earnings. Cyclical and commodity companies share a common feature insofar as their value is often more dependent on the movement of a macro variable the commodity price or the growth in the underlying economy than it is on firm specific characteristics.

He maintained that an investor should. Valuing cyclical and commodity companies. Valuing cyclical and commodity companies abstract cyclical and commodity companies share a common feature insofar as their value is often more dependent on the movement of a macro variable the commodity price or the growth in the underlying economy than it is on firm specific characteristics.

Thus the value of an oil company is inextricably linked to the price. Aswath damodaran ups and downs. Once the model is regressed the regression provides a beta and a p value to determine its significance damodaran 2009.

Valuing cyclical and commodity companies by aswath damodaran the capm model is used to determine the relationship between oil price and operating income in a firm. Automobile manufacturers airlines furniture steel paper heavy machinery hotels and expensive restaurants are the best examples. Profits and share prices of cyclical companies tend to follow the up and downs of the economy.

Valuing cyclical and commodity companies from aswath damodaran pdf peoplesternnyuedu submitted 4 years ago by iliveinaswamp student undergrad 1 comment. Valuing cyclical stocks. Valuing cyclical and commodity companies.

Ben graham the dean of wall street and father of value investing came up with a solution almost 70 years ago. Eastern monday friday. Thats why they are called cyclicals.

Dark Side Of Valuation The Valuing Young Distressed And

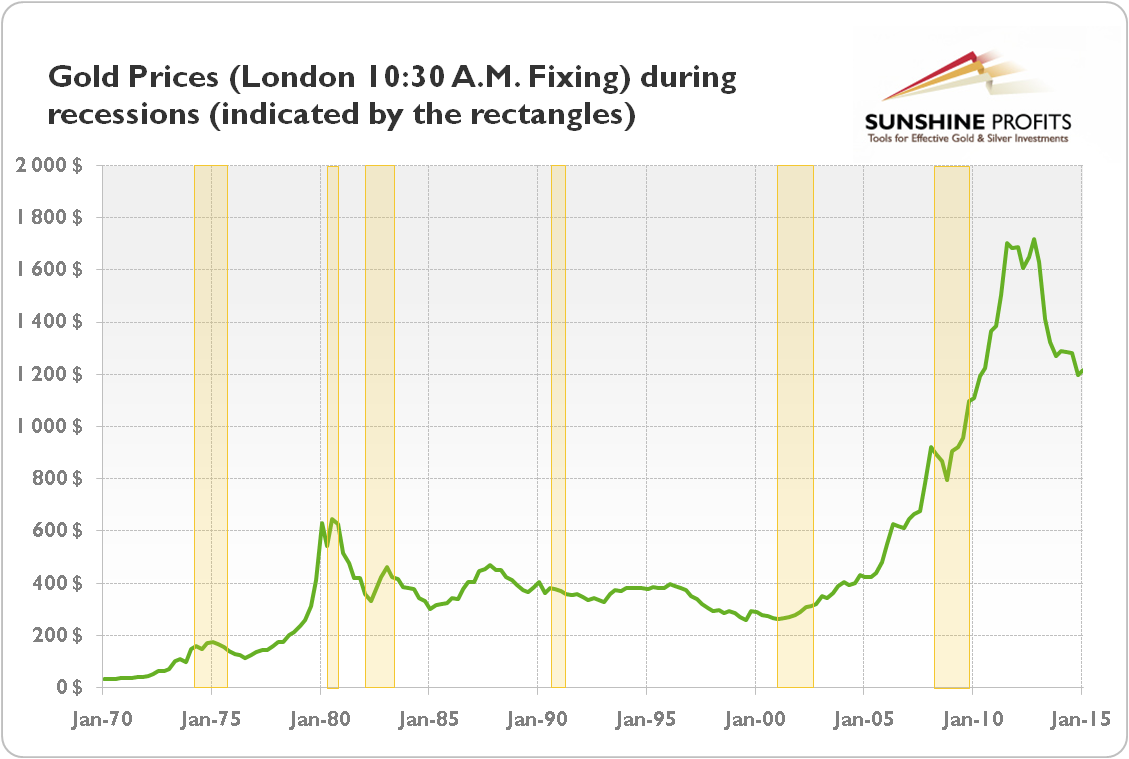

Gold Cycle Analyze Predict And Profit Sunshine Profits

Schwab Sector Views Coronavirus Changes Our Views Charles Schwab

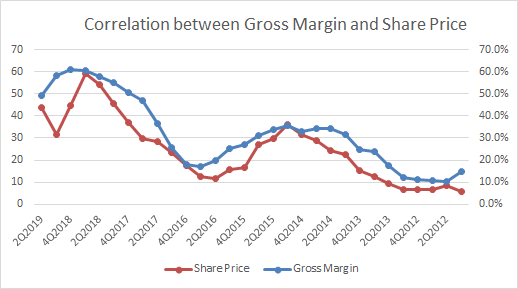

Micron Technology A Commodity Company In Its Down Cycle Micron

Gold Cycle Analyze Predict And Profit Sunshine Profits

Daily Investing Tips 365 Days Of Investing Insights

Theme Library Search Precious Metals Commodities

Valuation How To Value Cyclical And Commodity Companies

Proxy Statement